Blog 3 – PA 510 January 24th, 2011

This was the third class of PSU’s 2011 iteration of the Smart Grid Course – a path breaking instructional offering that for the last three years has been delivering the best thinking and newest developments pertaining to the implementation of this new technology and the evolution of this new paradigm for energy delivery.

In this third class, PGE’s Steve Hawke, SVP for Transmission and Distribution talks about how he views the Smart Grid challenges. He sees this as an opportunity to introduce more effective market signals to replace the cumbersome direction of regulation.

Jeff Hammarlund followed this presentation with a review of how the current electrical distribution system evolved from Edison and Westinghouse’s days – with a special emphasis on implementations that shaped the Pacific Northwest T&D environment.

Finally, Conrad Eustis, Director, Retail Technology Development at PGE, then introduced the basic elements the Mart Grid interoperability challenge and how PGE was trying to comply with the NIST interoperability model. This presentation was continued on January 31st and served as the foundation for Linda Rankin’s presentation of system architectures.

And to help us on our way to becoming even smarter about Smart Grid, we were honored to have Steve Hawke, Senior Vice President, Customer Service, Transmission and Distribution at Portland General Electric talk to us about why PGE is so supportive of the Smart Grid.

The gist of his energetic presentation was that the energy paradigm was rapidly changing and that new aggregators were entering the field whose business models might eventually pose a huge threat to large and ev en mid-sized electric utilities, like PGE.

en mid-sized electric utilities, like PGE.

PGE is a regulated monopoly.

PGE is mid-size company. It’s not so big that they’re hampered by their internal processes and/or the costs of embarking on new investments, nor are they so small that they haven’t got the resources. PGE is trying to be a “good early adopter” and pick their “sweet” spot. Like all other companies PGE has to consider its (business) environment.

All providers of energy are regulated monopolies in the United States. PGE is regulated by a public utility commission. Municipal boards regulate municipal utilities; customers regulate their cooperative utilities. They are regulated because they’re capital intensive. Building a transmission line from Boardman to Salem costs $1 billion. And when you invest that kind of money and later PacifiCorp builds an identical line right next door spending the same investment again it is not an efficient use of public resources – this is the basis of the regulatory structure that has evolved since the early 1900’s. The way we provide electric service in this country has been developed around a regulated monopoly business model. That’s not a given for all time. There have been lots of previous monopolies that are no longer regulated:

invest that kind of money and later PacifiCorp builds an identical line right next door spending the same investment again it is not an efficient use of public resources – this is the basis of the regulatory structure that has evolved since the early 1900’s. The way we provide electric service in this country has been developed around a regulated monopoly business model. That’s not a given for all time. There have been lots of previous monopolies that are no longer regulated:

Grain silos, insurance salesmen and even movie ticket sales were once regulated. AT&T was the biggest regulated monopoly. In 1981 MCI introduced the first mobile phone. Initially MCI attacked only one tiny part of AT&T’s service – the long distance routes from Los Angeles to New York. The legal basis for the challenge was that competition could provide a more reliable and lower cost service. Eventually this argument stripped AT&T of its lucrative business lines. AT&T was left with only their least profitable lines and could no longer cross subsidize its remaining services. Within 10 years the AT&T business model collapsed.

So over the course of the last three decades we’ve seen a change from a $12 per month regulated land line service to the home replaced by a smart mobile phone line, with internet and cable that can supply various data formats pouring out nearly unlimited data streams that cost somewhere between $250 and $300 per month. That’s the value proposition that we get when you replace the regulatory structure with free market competition. That’s what you get when technology, “legal” and politics support a change from a regulated monopoly to a competitive enterprise.

Deregulation has been tried.

The idea was that technology had developed to the point that utilities could offer unlimited supply. It was presumed that investors would build speculative power plants that would drive down the cost of energy. It turned out to be too early for that business model. It failed miserably. Prices went up and California went into a tailspin. The legacy of that disaster still haunts the industry. The regulated business model is not sacrosanct and changes in a number of different ways when attacked.

How does PGE see its business environment?

1. Electricity is the most important product over the last century.

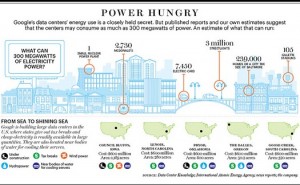

2. Electricity will see increased use until 2080. We will need 8-12 times more power on the planet than we have now; in the US we’ll need twice the energy we use now.

3. A system that takes 3 million years to set up but is used up in 80-90 years is not sustainable. The transportation system burns up 24 times more energy each day than  all the generation plants in the country, mainly because the car is so inefficient. From the utility’s perspective, you can’t just look at one part of the environmental problem. You have to look at the entire system when you’re trying to decide where do you want to spend your time trying to solve the carbon problem? In other words, the transportation system is another place where PGE might be able to derive more energy savings to meet their energy savings goals. Hence PGE’s support for the emerging EV industry…

all the generation plants in the country, mainly because the car is so inefficient. From the utility’s perspective, you can’t just look at one part of the environmental problem. You have to look at the entire system when you’re trying to decide where do you want to spend your time trying to solve the carbon problem? In other words, the transportation system is another place where PGE might be able to derive more energy savings to meet their energy savings goals. Hence PGE’s support for the emerging EV industry…

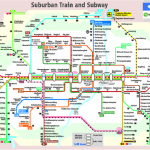

4. The North American transmission and distribution system is the most complicated system in existence. It has a product that moves at the speed of light and circles the equator 7.5 times in a second, and yet we choose to have more than 3000 people manage it! It has evolved organically; you would never plan to run it the way it is currently managed! From the utility’s perspective they are saddled with an antiquated delivery infrastructure that desperately need renovation.

5. According to the basic law of thermodynamics everything gets reduced to heat. Heat is the common currency of energy. Energy efficiency is about conserving heat; industrial efficiencies try to reduce line loss and heat dissipation. Over time we will begin to consider how we reduce all emissions. We’ll eventually have to consider how to reduce emissions of all chemical substances. In the end we’ll be talking about heat as a currency. From the utility’s perspective, the current focus on carbon is just the beginning; we will have to reconsider all emissions.

6. Utilities have a load curve that resembles a (two humped) “Bactrian camel”. Of  course, the ideal load curve for a utility would be a flat load curve so that a steady and cheap energy source can satisfy the demand and minimize loss of heat. Similarly to the regulated telecommunications business model, utilities blend the different cost structures of their businesses to develop the most compelling value propositions for the different customers classes that they serve. This blending of cost structures depends upon their ability to cross-subsidize different business products.

course, the ideal load curve for a utility would be a flat load curve so that a steady and cheap energy source can satisfy the demand and minimize loss of heat. Similarly to the regulated telecommunications business model, utilities blend the different cost structures of their businesses to develop the most compelling value propositions for the different customers classes that they serve. This blending of cost structures depends upon their ability to cross-subsidize different business products.

7. Legal challenges to this regulated monopoly business model tend to focus on those lucrative business products and services that sustain the cross-subsidization of less profitable, but necessary product lines. Typically sophisticated services aimed at mid-sized businesses are priced well above their delivery costs. Legal challenges to the regulated monopoly business models have contended that precisely these lucrative services can be reliably delivered at a much lower cost. No doubt this is true, but the gradual deregulation of the profitable lines of business will eventually collapse the utilities’ ability to cross-subsidize the portfolio of products they are required to provide. The most successful way to attack a regulated business is to “skim off the cream”, or acquire the most lucrative customers while leaving the regulated model with the less profitable customers.

Why is this relevant to PGE? If a competitor were able to skim off those customers with a flatter load curve, they would be able to provide those customers with a lower cost solution and still generate enough profit for shareholders. Unfortunately, this gradual syphoning off of customers with flatter load curves will undercut the utilities’ ability to profitably serve those customers with a more variable load curves.

Today PGE is able to provide its customers with reliable service because they are able to aggregate all the customers in a territory. But what if another unregulated competitor were to be able to aggregate these same energy users and “cream skim” the most lucrative customers? Who might these more efficient aggregators be? Possibly Google – they also have all the customers in the country. Any technology that can provide energy storage, or that could bypass wires would have a significant competitive advantage.

Today PGE is able to provide its customers with reliable service because they are able to aggregate all the customers in a territory. But what if another unregulated competitor were to be able to aggregate these same energy users and “cream skim” the most lucrative customers? Who might these more efficient aggregators be? Possibly Google – they also have all the customers in the country. Any technology that can provide energy storage, or that could bypass wires would have a significant competitive advantage.

The question that PGE is seeking to answer is how to survive the gradual deregulation of the energy industry. It may take as long as fifty years to bring down the cost of energy delivery to a deregulated price point. Deregulation may also engender a more distributed infrastructure that can withstand security challenges.

__________________________________________________________________________

Wiring the Smart Grid into History: the Historical Precedents of the Smart Grid.

Wiring the Smart Grid into History: the Historical Precedents of the Smart Grid.

– Jeff Hammarlund

Jeff quickly summarized the “key components of a systems framework to support the smart grid” that he had discussed at the end of the class on January 18th.

Drawing in part from the work of Mark Johnson and Josh Suskewicz of Innosight, Jeff had postulated that new clean-tech initiatives like the smart grid had the best chance for success when a systemic framework was established that offered four interdependent and mutually reinforcing components. They were:

1. An enabling technological system. A technological breakthrough is not enough. Edison recognized this with the invention of the light bulb. Although he did borrow a few components from the legacy lighting systems, but he wouldn’t have been successful without the development of an enabling technology system that produced wires, generators, meters, transmission lines, and new appliances that had to be built from the ground up.

2. An innovative business model. Success requires combining a technological breakthrough with a business model that provides value for both the customer and the company.

3. A market adoption strategy that ensures a foothold. The smart grid and other clean-tech systems, like the systems they are intended to modify or replace, are complicated. They are fraught with unknowns and how best to integrate their parts won’t be clear at the outset. Smart Grid advocates need to be humble, nimble, and willing to act when their initial hunches turn out to be wrong. When possible, they should incubate their new ventures outside demanding, competitive markets—in foothold markets, where the value proposition offered by even early-stage technologies and business models is so great that customers are willing to overlook their shortcomings. Portland might serve as such an accommodating incubator for hosting a pilot that links demand response programs with electric vehicles via the emerging Smart Grid.

4. A favorable government policy. Federal support for the smart grid has been vital, particularly given the depressed economy. But it is not without risks. Government support is most effective when it is directed not just at new technologies but at new business models as well. For instance, in the early 1900’s, Samuel Insull’s development of the regulatory concept of a “natural monopoly” and the related concept of a “load factor” were instrumental in producing a regulatory compact that allowed the industry to develop more compelling value propositions while still responding to public policy requirements.

A Short History of the electrical industry in the Pacific Northwest.

– Jeff Hammarlund

After this brief review of favorable systemic conditions, Jeff began to outline the original development of electricity, and the early transmission and distribution systems. He described Edison’s opening of the Pearl Street Station on September 4th, 1882 near Wall Street. The original $160,000 power plant served an area of only 1/6 sq. mile and included the stock exchange, two newspapers and several prominent investment banks.

Jeff then described the fierce competition between Westinghouse and Edison. The population remained very skeptical of this technology fearing electrocution. Edison actually founded the first co-generation plant when he used the steam from his powerhouse to heat nearby offices. But the limited reach of the DC current meant that Edison had to build twenty separate transmission and distribution systems. Nonetheless, Edison also believed that only direct current (DC) transmission lines could make it possible to transmit power over longer distances, such as the 14 miles that separated Oregon City and Portland – his first demonstration projects in the West. Much of this history that Jeff summarized was gleaned from his 2002 draft article on Oregon’s Role as an Energy Innovator. The following citations (in italics) are taken from the above reference article.

The Battle of the Currents

When Edison refused to listen, Tesla quit and joined forces with Edison’s chief rival, George Westinghouse. The Pittsburgh-based industrialist had just bought out some of Edison’s other competitors and boasted that his new Westinghouse Electric and Manufacturing Company would become “the most progressive” company in the field. As a young man, Westinghouse had been an inventor in his own right; his most famous invention was the railroad air brake on his 23rd birthday. He was both excited by Tesla’s inventions and intrigued by the young Serb’s claims that he was a “scientific mystic” whose inventions came from “spiritual visions.” After purchasing the rights to Tesla’s 40 AC patents, including the polyphase AC and the induction motor, Westinghouse hired the young emigrant as director of research. Together, they began to develop and market Tesla’s inventions. Thus began the “Battle of the Currents” between the two camps. …Tesla insisted that his system offered two important advantages. First, the electricity could travel much further, possibly many miles from a remote power plant to a population center. Second, the voltage from a single polyphase AC system could be stepped up or down to meet the specific power requirements of residential, commercial, or industrial customers.

The operators of Willamette Falls Electric where the first long distance transmission line to Portland was to be installed were not cowed by Edison’s scare tactics. After the success of the initial DC transmission, they nonetheless switched to AC. The Willamette Falls Electric transmission test confirmed Tesla’s contention that transmission with AC would significantly reduce power losses over the lines. In fact, the amount of line losses was even less than Tesla had anticipated.

Henry Villard and the Genesis of PGE

In January of 1880, just three months after Thomas Edison invented the incandescent light bulb, shipping and railroad magnate Henry Villard, owner of the Oregon Railroad and Navigation Company, gave Edison’s fledgling company its first commercial order. Four small electric generators called dynamos were placed in the engine room of Villard’s new ship, the SS Columbia. Each generator lit 60 small lamps of 16 candlepower. Once the ship reached Portland in the fall of 1880, wires were strung from ship to shore to light up a lamp hung from the porch of Portland’s Clarendon Hotel. “The powerful rays lighted up the whole neighborhood to the brightness of day,” proclaimed The Oregonian. Sensing the significance of the event, an accompanying editorial boasted, “The enterprise of a Western railroad gives Edison’s greatest invention, the electric light, its first practical use while the conservative East is still trying to laugh it off as a ridiculous joke.”

Villard began to invest heavily in the fledging Edison General Electric Company and, by 1888, had been elected as the company’s president. The novel idea of festoon lighting appealed to many Northwest shop owners, most notably the proprietors of our popular saloons, and soon many companies sprang up to offer this service. In Seattle alone, nearly 30 minuscule start-up companies placed dynamos in their basements and competed for this cutting edge business. But start-up costs were high and potential customers were more curious than convinced in the viability of electricity. . Most failed in the financial panic of 1893.

In more laid-back Portland, a firm that built hydraulic elevators bought three steam dynamos in 1884. Using excess steam from the elevator company’s boilers, each dynamo powered 20 light bulbs. Under the grandiose name of United States Electric Light and Power Company, the tiny company soon proved itself to be the most successful utility in town. This was the predecessor of today’s PGE.

Insull and the Regulatory Compact

From the beginning, the most successful electric holding company was J. Pierpont Morgan’s Electric Bond and Share Company. When J. Pierpont Morgan died in 1912, his son, J.P. Morgan, Jr., continued his efforts to use the holding company structure to consolidate the utility industry. Morgan Jr.’s goal was to make the United Corporation the dominant power in the utility industry. While he never fully succeeded, he and his 17 partners controlled 13 utility holding companies which controlled a network of utilities from coast to coast.

The only large utility holding company independent of the House of Morgan was controlled by Thomas Edison’s former personal secretary, Samuel Insull. After

witnessing Edison lose control of his Edison General Electric to the elder Morgan, Insull moved to Chicago to manage a fledgling utility and he quickly demonstrated remarkable business acumen and political savvy to make his utility, now known as Commonwealth Edison, into the dominant regional energy provider.

Insull proved to be one of the most innovative leaders in the young electric utility industry. He was the first to demonstrate the profitability of linking central generating systems, small towns, and rural areas with extensive distribution systems. And he was one of the leading proponents of state regulation of inventor-owned utilities.

Insull argued that utilities were “natural monopolies”. He insisted that competition was not in the best interests of either company owners or the customers since competing power lines and power plants increased costs for consumers and reduced company profits. The costs of generating, transmitting, or distributing electricity would be lower if only one company handled all these functions in a particular area.

Insull’s vision was to establish electricity as an “essential service” and to assign utilities specific service territories. In return, the utilities would agree to serve all the customers in their territories and they would be granted a set rate of return for their services. They would be regulated according to their ownership. Municipal electric companies were regulated by city councils, rural cooperatives by their customers, investor owned utilities by the public utility commissions, and public utilities by their county commissions.

In ’35 NW had 8 IOU’s and 42 citizen owned utilities. The scope of state authorities varied. The federal wholesale rates and the local retail rates were regulated to be “just and reasonable”. The basic principles used by the regulatory bodies was:

- That utilities were to operate safely and reliably

- At rates which were both just and reasonable.

- Utilities could recover prudently invested costs, and

- They were allowed to earn a reasonable rate of return.

At this point, Jeff concluded his presentation in order to give Conrad sufficient time to present his overview of how utilities structure their responsibilities and how that relates to the successful implementation of the Smart Grid.

______________________________________________________________________________

– Conrad Eustis

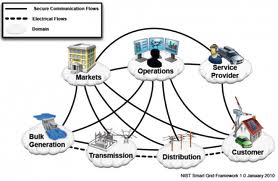

Towards the end of the class Conrad began his presentation on how utilities operate today and the implications of the management structure on the implementation of the Smart Grid. Conrad began with an explanation of the National Institute for Standards and Technology’s (NIST) model for the Smart Grid.

The NIST conceptual model divides the functions into four categories:

1. The service provider

2. The markets – where we get energy

3. Operations, including:

a. power generation

b. transmission operator

c. distribution and repair

d. Customer premise management

All these elements should be interoperable!

Initially Conrad began to map out the major functions of an actual electric utility.

Initially Conrad began to map out the major functions of an actual electric utility.

For instance, the typical service provider functions included:

- Develop Product Offers

- Start/Stop Service

- Read Meter

- Calculate Bill

- Answer Questions

- Acknowledge Outage

The operations function included the following tasks:

- Acquire Energy for Tomorrow

- Maintain Grid Stability

- Reroute Power to minimize customers out of power

- FERC: Control Area Operator

- Repair Broken Wires

- Distribution Sys Operator

The transmission and distribution functions included:

- Create new Services

- Upgrade Plant as Required

- Create and Monitor Telemetry

And finally, the bulk generation function included:

- Build, Operate and Maintain Power plants

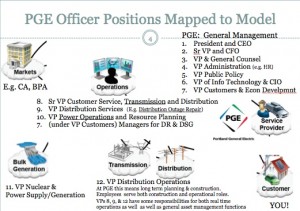

Then he mapped PGE’s officer positions to the NIST model.

- 7 administrative officer positions were directly related to the Service Provider role.

- 3 operational roles mapped to Operations,

- 1 executive mapped to the transmission and distribution functions, and

- 1 executive was assigned to the bulk generation function.

The clear lessons to be learned from this superimposition of the theoretical NIST model over an actual utility was that there are many areas where the interoperability function had just been initiated and was not yet completely interoperable. In most cases the interoperability had not yet been addressed, and in many other cases it was still under construction.

That concluded the third session of the Smart Grid Class on January 24th, 2011.

That concluded the third session of the Smart Grid Class on January 24th, 2011.